Navigating the World of Business Funding

Starting a new business can be an exciting venture, but it can also be daunting, especially when it comes to securing funding. As a beginner in the world of entrepreneurship, understanding the different options available for business funding is crucial to your success. In this guide, we will explore the various funding options available to help you navigate the world of business financing.

One of the most common sources of business funding for beginners is bootstrapping. Bootstrapping involves using your own personal savings or resources to fund your business. While this may limit the amount of capital you have to work with, it can also give you full control over your business without having to answer to external investors. Bootstrapping is a great option for those who are just starting out and may not have access to other funding sources.

Another popular option for business funding is seeking out a small business loan. Many banks and financial institutions offer loans specifically designed for small businesses. These loans can provide you with the capital you need to get your business off the ground and can be used for a variety of purposes, such as purchasing equipment, hiring employees, or expanding your operations. It’s important to research different loan options and shop around for the best interest rates and terms that fit your business’s needs.

If you’re not keen on taking out a loan, you may want to consider seeking out investors to fund your business. Angel investors and venture capitalists are individuals or firms who are willing to invest in promising startups in exchange for equity in the company. While this can be a more complex and time-consuming process, it can also provide you with the financial backing and expertise needed to grow your business quickly. Before seeking out investors, make sure to have a solid business plan and be prepared to pitch your idea effectively.

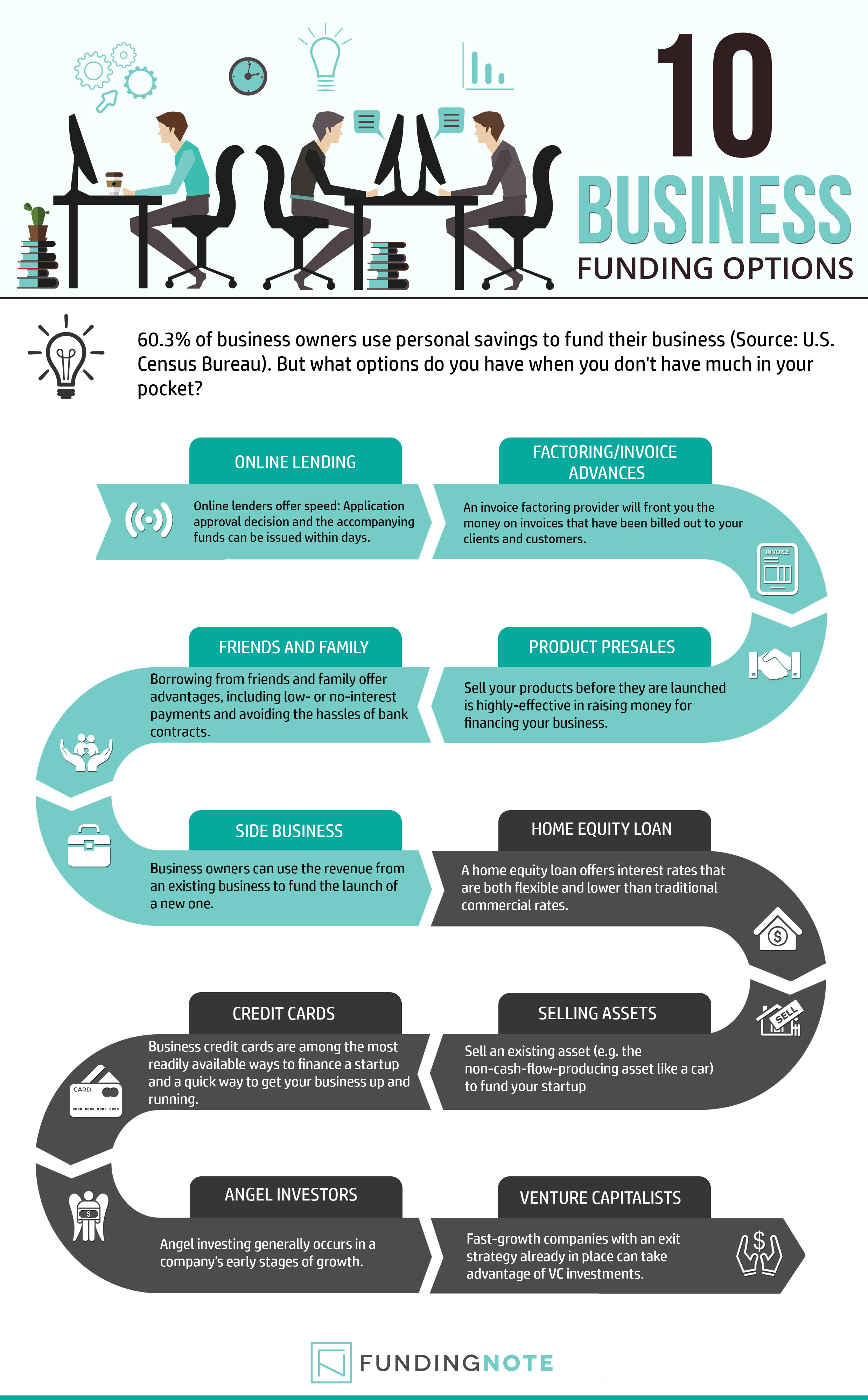

Image Source: fundingnote.com

Crowdfunding has become an increasingly popular option for entrepreneurs looking to raise funds for their businesses. Platforms like Kickstarter and Indiegogo allow you to pitch your business idea to a large audience of potential backers and raise money through small contributions. Crowdfunding can be a great way to not only raise capital but also generate buzz and interest around your business. However, it’s important to have a strong marketing strategy in place to stand out from the competition and attract backers.

If you’re looking for a more traditional route, you may want to explore grants and competitions specifically geared towards small businesses. Many government agencies, nonprofit organizations, and corporations offer grants and contests that can provide you with the funding you need to kickstart your business. While the application process can be competitive, winning a grant or competition can provide you with valuable funding and recognition for your business.

In conclusion, navigating the world of business funding as a beginner can be a challenging but rewarding experience. By exploring the various funding options available, from bootstrapping to seeking out investors or crowdfunding, you can find the right financing solution that fits your business’s needs. Remember to do your research, create a solid business plan, and be prepared to pitch your idea effectively to secure the funding you need to succeed. With the right funding in place, your business can thrive and unlock opportunities for success.

Unlocking Opportunities for Your Success

Starting a business is an exciting journey filled with opportunities for growth and success. However, one of the biggest challenges that new entrepreneurs face is securing the necessary funding to get their business off the ground. Fortunately, there are a variety of funding options available to help turn your business dreams into a reality. In this article, we will explore some of the key funding options that can unlock opportunities for your success.

One of the most common ways to fund a new business is through a traditional bank loan. Banks offer a range of loan options for small businesses, including term loans, lines of credit, and SBA loans. While bank loans can be a reliable source of funding, they often require a strong credit history and collateral to secure the loan. Additionally, the application process can be lengthy and may require detailed financial documentation.

Another popular funding option for new businesses is angel investors and venture capitalists. These investors provide capital in exchange for equity in the company. Angel investors are typically individuals who invest their own money into early-stage startups, while venture capitalists are firms that manage funds from multiple investors. Securing funding from angel investors or venture capitalists can be a competitive process, but it can also provide valuable expertise and connections to help grow your business.

Crowdfunding has also become a popular way for entrepreneurs to raise capital for their businesses. Platforms like Kickstarter and Indiegogo allow entrepreneurs to pitch their business ideas to a large audience and raise funds from individual backers. Crowdfunding can be a great way to validate your business idea and generate buzz around your brand. However, it requires a strong marketing strategy and a compelling pitch to stand out among the thousands of other campaigns on these platforms.

For businesses in the technology or innovation space, government grants and subsidies can be a valuable source of funding. Many governments offer grants and subsidies to support research and development in key industries. These grants can help offset the costs of developing new products or technologies and provide a competitive advantage in the market. However, the application process for government grants can be complex and time-consuming, so it’s important to do your research and seek assistance from experts in grant writing.

If you are a minority or woman-owned business, there are also specific funding options available to support your entrepreneurial endeavors. Many organizations and government agencies offer grants, loans, and mentorship programs specifically designed to help minority and women entrepreneurs succeed. These programs can provide access to capital, networking opportunities, and business education to help you grow your business and achieve your goals.

In conclusion, there are a variety of funding options available to help new entrepreneurs unlock opportunities for success. Whether you choose to pursue a traditional bank loan, seek funding from angel investors, explore crowdfunding, apply for government grants, or tap into resources for minority and women-owned businesses, there are countless ways to fund your business dreams. By exploring these funding options and finding the right fit for your business, you can set yourself up for success and take your business to new heights.

The Ultimate Guide to Business Funding Options